Out-of-home (OOH) advertising has come a long way from the traditional billboards and transit ads of the past. In today’s global marketplace, OOH has evolved into a dynamic and tech-driven channel that allows brands to reach audiences in innovative ways across multiple markets.

The Growth of International OOH

While OOH was once seen as a more localised advertising medium, the rise of digital signage, programmatic buying, and data-driven targeting has opened up new frontiers worldwide.

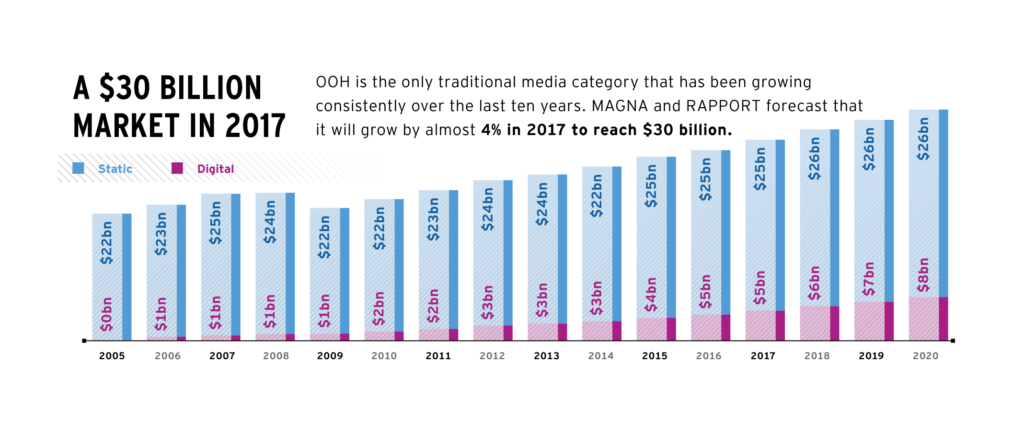

According to WARC, global OOH ad spend grew by 10.1% in 2022 and is projected to have increased by 7.2% in 2023. This growth is fuelled by advertiser demand for omnichannel campaigns and the ability to deliver contextually relevant messaging.

Key OOH Markets Around the World

Some of the biggest spenders and most mature OOH markets are concentrated in North America, Europe, and Asia-Pacific regions:

United States

The U.S. is the largest OOH market globally, with an estimated spend of $8 billion in 2022 according to the Out of Home Advertising Association of America (OAAA).

Digital OOH accounts for 39% of total OOH spend, with that percentage continuing to grow rapidly.

Major cities like New York, Los Angeles, and Chicago are OOH hubs with iconic placements like Times Square billboards.

Top OOH companies include Clear Channel Outdoor, Outfront Media, Lamar Advertising, JCDecaux, and Intersection.

United Kingdom

The UK OOH market was valued at £1.35 billion ($1.7 billion) in 2022 and is forecast to reach £1.4 billion by 2024 (WARC).

London accounts for over 25% of the UK’s total OOH revenue given its population density and traffic.

Transport environments like the London Underground are highly valued OOH ad locations.

Leading OOH media owners are JCDecaux, Clear Channel Outdoor, Global Media, Ocean Outdoor, and BlowUP media.

China

China had the world’s fastest-growing OOH ad market in 2021, valued at around $10 billion (WARC).

Digital OOH accounts for a significant portion, leveraging large-format LED screens in major cities.

Key OOH players include Focus Media, Framedia, Air Media, and Xinchao Media.

Rapid urbanisation, infrastructure development and investment in digital signage networks are fuelling growth.

Australia

Australia’s OOH market was worth over $1 billion in 2022, with an 18% year-over-year increase (Outdoor Media Association).

Digital OOH comprises around 57.5% of total revenue, one of the highest digital shares globally.

Major companies are OOHMedia, JCDecaux, OmniCom, and QMS Media.

Roadside billboards account for the biggest share, followed by retail/lifestyle venues.

Brazil

Brazil has one of the largest OOH ad markets in Latin America at over $600 million annually.

São Paulo is considered the “outdoor media capital” of the country with heavy spend and iconic placements.

Leading firms include Clear Channel, JCDecaux, Vert, and IPPS.

Transit environments like bus shelters and the São Paulo subway system are major OOH channels.

Global OOH Innovation

As audiences become more mobile and connected, the OOH industry is rapidly evolving across international markets to deliver more contextual, interactive, and data-driven experiences:

Audience Data and Measurement

- Leveraging mobile data, AI/machine learning, and location analytics to map and activate against real-world audience movements for smarter targeting

- Global players like Moving Worlds enabling OOH planning based on demographics, points of interest, weather data and more

- Advances in automated audience measurement using computer vision, WiFi tracking, IoT sensors to quantify impressions

Programmatic DOOH Growth

- Programmatic buying of digital OOH (pDOOH) is becoming mainstream, allowing more flexibility and creative versatility

- Global DSPs like Hivestack and Vizsense connecting brands to pDOOH inventories worldwide for smarter planning

- Enabling ad rendering optimisation, dynamic creative refresh, tighter omnichannel integrations and campaign analytics

Mobile Device Integrations

- Location-based OOH triggers delivered to smartphone users for engagement like gamification, social sharing, augmented reality

- QR codes, NFC, and other contactless activations bridging the physical and digital worlds

- Interactive digital screens with mobile integrations driving e-commerce, calls-to-action and content downloads

Immersive OOH Executions

- Creative use of large-scale 3D anamorphic, projection mapping, and augmented reality overlays onto urban environments

- Experiential OOH activations like wrapped “advertised” homes/venues, branded art exhibits, and pop-up executions

- Driving earned media impressions and online sharing through shareable, buzz worthy OOH spectacles

Sustainable and Green OOH

- Rise of renewable energy-powered digital screens using solar, wind, and kinetic paver technologies

- Brands embracing sustainable OOH with messaging focused on environmental causes and initiatives

- Programs to recycle printed OOH inventory and adopt more eco-friendly materials/production

Data-driven efficiency, audience interactivity, immersive experiences, and sustainability are becoming core priorities as OOH embraces technological innovations worldwide. The medium is transcending its traditional roots to create more dynamic, measurable connections with today’s mobile consumer.

Major OOH media suppliers globally are investing in R&D and partnerships to pilot these new solutions as brands demand greater accountability and creative impact from their OOH spend. As 5G and the IoT ecosystem evolve, we’ll continue to see OOH pioneer smarter ways to integrate into the connected consumer journey.

Have an international OOH brief?

Get in touch with us today to discuss your brand’s requirements. Our specialists will work closely with you to craft data-drive OOH solutions that deliver meaningful connections across the world.